FuelEU Maritime applies from 2025 – What you need to know

In this briefing, Johanna Ohlman and Alessio Sbraga of HFW take you through the key aspects, dates and compliance pathways for the EU’s new FuelEU Maritime Regulation.

Key aspects

FuelEU Maritime Regulation (“FuelEU”) is part of the European Union’s (“EU”) Fit for 55 Package of legislative measures working towards the goal of reducing EU emissions overall by at least 55% by 2030. Combined with the inclusion of maritime transport in the EU’s Emission Trading System (EU ETS), FuelEU aims to accelerate shipping’s green transition.

FuelEU is the first regional regulation targeting the greenhouse gas emission (“GHG”) intensity of energy used onboard ships (including but not limited to maritime fuels) on a well-to-wake (“WtW”) basis. This means that the GHG intensity of the production of a maritime fuel is just as important as the GHG intensity of burning the fuel onboard. FuelEU sets a GHG intensity limit that ships must meet, with the limit decreasing at regular intervals.

FuelEU will apply (with limited exceptions) to ships over 5,000 GT calling at EEA ports from 1 January 2025. From this date, ships in scope are required to measure the GHG intensity of all energy used on board on qualifying voyages or port stays. For stays in EEA ports and voyages between EEA ports, 100% of energy used will fall within scope. For voyages between an EEA port and a non-EEA port, only 50% of energy used will be within scope.

Ships in scope will be assigned an annual compliance balance, which will reflect either a ‘surplus’ or a ‘deficit’ based on whether the annual average GHG intensity of energy used onboard exceeds or fails to meet the set GHG intensity limit. A compliant ship will be issued with a FuelEU Document of Compliance (“FuelEU DOC“), whereas a non-compliant ship will be required to pay a FuelEU Penalty.

FuelEU also imposes future obligations:

- From 1 January 2030, containerships and passenger ships must connect to Onshore Power Supply (OPS) at applicable ports;

- From 1 January 2034, a sub-target may apply to require use of renewable fuels of non-biological origins (“RFNBOs“).

The responsibility for compliance with FuelEU lies with the “company”. This is defined under Article 3(13) as “the shipowner or any other organisation or person such as the manager or the bareboat charterer, which has assumed the responsibility for the operation of the ship“. In effect, this means the entity that has agreed to undertake the obligations set out in the ISM Code. The “company” responsible for compliance with FuelEU would therefore be the holder of the ISM Document of Compliance (ISM DOC). The ISM DOC holder is often the ship’s technical manager.

Compliance periods and key dates

FuelEU requires companies to take steps on a year-by-year basis through the following periods:

- Starting from 1 January 2025, monitor and record the GHG intensity of fuels and other energy used on board for the calendar year (the “Reporting Period“);

- In the calendar year following each Reporting Period (the “Verification Period“) and starting from 1 January 2026, report and verify the GHG intensity .

Monitoring and recording of GHG intensity is done in accordance with the FuelEU monitoring plan throughout the Reporting Period and recorded electronically on the FuelEU database. Companies should already have submitted a FuelEU monitoring plan to the verifier (by 31 August 2024) and any necessary updates (as directed by the verifier) should be made before 1 January 2025. The company is free to choose the verifier for their ships. The verifier is an independent and accredited entity under FuelEU and can (but does not have to be) the same verifier as under the Monitoring Reporting and Verification (MRV) Regulation.

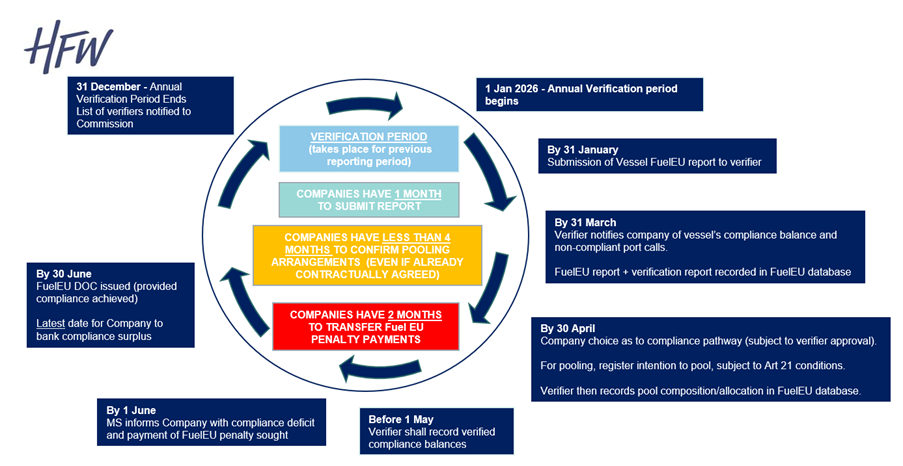

The Verification Period then begins, with a number of key dates set out in the below diagram. In particular, it is important to bear in mind the short deadlines in the first few months of the Verification Period:

- By 31 January, companies must submit their FuelEU report (containing all required data) to the verifier for each ship they are responsible for.

- By 31 March, the verifier will calculate and notify the company of the ship’s compliance balance.

- The company will have one month to select its compliance pathway and must notify the verifier in this regard by 30 April.

- By 30 June, the company must have paid any applicable FuelEU Penalty and the ship will be issued with the FuelEU DOCA failure to pay a FuelEU Penalty for two consecutive Reporting Periods will lead to expulsion orders and/or flag detention.

Because of the Verification Period’s short timeframes, it is crucial for companies to consider in advance what compliance pathways are workable for each ship. Delays in decision-making and failing to have the necessary arrangements in place could result in costly consequences.

How to comply?

FuelEU offers companies different compliance pathways for the ship to avoid a compliance deficit and in turn be issued with a FuelEU DOC. Companies should now evaluate and decide what pathways aligns with their operational needs and FuelEU compliance strategy.

These compliance pathways are:

- Banking: Companies with a compliance surplus can bank the surplus indefinitely for future use in later Reporting Periods.

- Pooling: Pooling enables companies to combine their ships’ compliance surplus or deficit with those of other ships, helping to distribute the risks and costs associated with compliance which may also result in commercial gains. There is no restriction on which ships can pool and different owners or operators can therefore pool unrelated ships together. However, it is essential to carefully evaluate potential pooling partners and weigh the associated risks and benefits. Pooling is a flexible tool with limited conditions (importantly, the pool’s total compliance balance must be positive and a ship may only pool once). Contractual pooling arrangements are likely to play an instrumental role in ensuring compliance and may also enable stakeholders to monetize FuelEU.

- Borrowing: Companies may borrow an advance compliance surplus from the next Reporting Period to address a compliance deficit. However, this approach requires careful consideration to prevent potential shortfalls in the future as a company cannot borrow for two consecutive reporting periods. Further, a multiplier of 1.1 is applied to the borrowed surplus, which means achieving a compliance surplus for future Verification Periods becomes more difficult.

- Switching to Less GHG Intensive Fuels: FuelEU aims to push companies to shift to lower-carbon maritime fuels such as LNG, biofuels, or RFNBOs. While these options can help reduce emissions, they often require significant investment in new technologies and may necessitate retrofitting existing ships. Additionally, they can lead to higher operational risks (where particular fuel blends are new and untested) and likely increased fuel costs (due to lower supply compared to conventional fuels).

- Paying the FuelEU Penalty: The most straightforward option would be for the company to pay the required FuelEU Penalty. As the annual GHG intensity limit decreases, the FuelEU Penalty will increase. Further, the FuelEU Penalty will be increased by 1/10 if the ship has a compliance deficit for two consecutive Reporting Periods. Paying the FuelEU Penalty is therefore unlikely to be viable long-term compliance pathway and may also turn out to be a more expensive option than other compliance pathways.

Key takeaways

As FuelEU starts applying from 2025, shipowners and managers must take proactive steps to ensure compliance, if they have not already done so.

At this stage, we recommend:

- Becoming familiarised with the FuelEU Database;

- Liaising with verifiers to understand what information will be provided in FuelEU reports and what data and information could be provided on an ongoing basis;

- Consider compliance pathways and what options are workable in your compliance strategy;

- Consider whether any compliance pathways require contractual arrangements (for example, a FuelEU pooling agreement);

- Reviewing contractual arrangements, including charterparties and ship management agreements, to identify any necessary amendments to account for rights and obligations arising under FuelEU;

- Consider the need for a bespoke FuelEU clause in contracts (BIMCO has recently published a FuelEU clause for time charterparties that can be found here and will also be producing a FuelEU clause for ship management agreements);

- Seek legal advice as necessary.

If you have any questions, please contact the authors of this briefing.

Johanna Ohlman, Associate, HFW

Alessio Sbraga, Partner, HFW

Research undertaken by Vasileios Zokaris, HFW.